|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

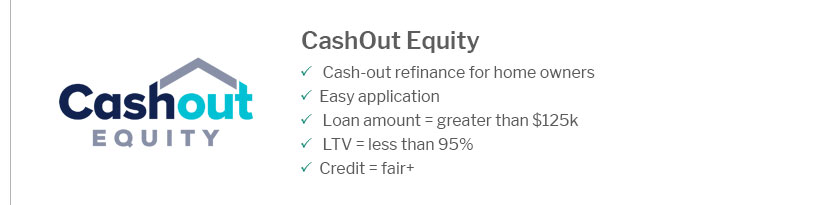

Approval for Home Equity Loan: Steps to Secure Your FundsUnderstanding Home Equity LoansHome equity loans allow homeowners to borrow against the value of their homes. These loans can be a great option for financing major expenses, consolidating debt, or funding home improvements. How They WorkHome equity loans are based on the difference between your home's market value and the remaining balance on your mortgage. This difference is known as equity. Steps to Get ApprovedEvaluate Your Financial HealthBefore applying, assess your financial situation. Check your credit score, outstanding debts, and income stability. Determine Your EquityCalculate how much equity you have. The more equity, the better your chances of approval and favorable terms. Research LendersResearch different lenders to find one that offers home loan low fees and terms that suit your needs. Compare interest rates and fees. What Lenders ConsiderCredit ScoreYour credit score is a major factor. A higher score can lead to better loan terms and interest rates. Debt-to-Income RatioLenders will assess your debt-to-income ratio to ensure you can handle additional debt. Loan-to-Value RatioThis ratio compares the loan amount to your home's value. A lower ratio can improve your chances of approval. Common Uses for Home Equity Loans

FAQConclusionSecuring a home equity loan involves understanding your financial health, researching lenders, and knowing what to expect during the approval process. By preparing adequately, you can find a lender offering todays refinance mortgage rates that meet your financial goals. https://www.creditkarma.com/home-loans/i/home-equity-loan-requirements

Home equity loan requirements can vary but having strong credit and a low debt-to-income ratio can increase your likelihood of approval. https://www.hfcuvt.com/post/heloc_application_process.html

To gain approval for a HELOC, lenders typically consider several factors, including how much equity you have in your home, your credit score, ... https://www.bankrate.com/home-equity/requirements-to-borrow-from-home-equity/

To qualify for a home equity loan or line of credit, you'll typically need at least 20 percent equity in your home. - You'll also need a solid ...

|

|---|